Review of Laimz casino After Some Real Use

Laimz is one of those Latvian casinos that tends to pop up often in ads, yet is easy to overlook. On closer inspection, however, it turns out to be a fairly well-put-together platform that avoids many of the clichés seen in so-called “international VIP” casino sites. It’s not perfect, but it doesn’t feel hastily assembled either.

First Impressions

The registration process is quick and straightforward — about two minutes in total. Users aren’t overwhelmed with unnecessary questions or required to upload ID immediately (although that will likely be needed later for withdrawals). The interface is clean and functional, if a little cartoonish in parts. The site features mascot-style characters such as Zerro and others, presumably as part of a gamified experience. While this design choice might not appeal to everyone, it doesn’t interfere with the actual usability of the platform.

Game Selection: Focused and Functional

Laimz offers a solid range of slot games, though it doesn’t try to boast an overwhelming catalogue. Titles from major providers like NetEnt, Play’n GO, and Microgaming form the backbone of the offering. Classic games such as Book of Ra Deluxe, Starburst, and 40 Super Hot are present, providing a familiar and stable experience. Loading times are quick, games run smoothly, and autoplay functions as expected.

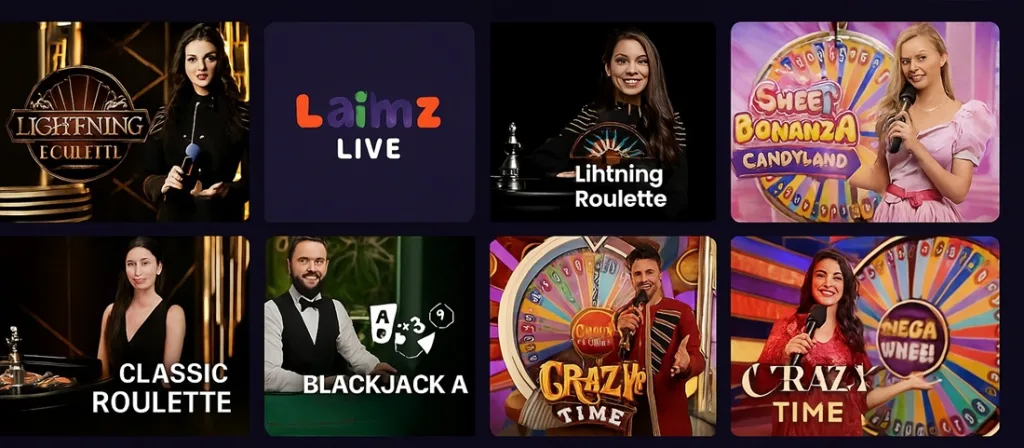

The live casino section is modest but functional, including the essentials — blackjack, roulette, and a few poker variants. It isn’t particularly flashy, but it performs reliably without technical issues.

Perhaps the most distinctive part of Laimz is its bingo offering. It’s more than a token inclusion — the platform supports active bingo rooms with 30, 75, 80, and 90-ball formats. These rooms feel genuinely social, with active chat and a player base that appears to engage regularly. It’s one of the most developed bingo environments currently available on Latvian casino platforms.

Bonuses and Promotions

At the time of writing, the welcome offer includes up to €200 cashback and 200 “risk-free” spins. The cashback amount depends on the deposit size, but even a modest deposit qualifies for partial returns. Risk-free spins are typically awarded on Starburst — a standard choice, though appreciated. The conditions attached to the offer are clear and not buried under excessive wagering requirements.

Ongoing promotions include WinSpins, bingo-focused deals, and other recurring offers. Promotions are generally well-spaced and not overly aggressive — a welcome contrast to sites that bombard users with pop-ups and flashing banners on every login.

Support and Payment Options

Customer support is available in Latvian, English, and Russian, with help resources presented clearly. While live support wasn’t personally tested, the available information suggests responsive service. Payment processing is fast — deposits via Swedbank were completed within minutes. Withdrawals are advertised as same-day (excluding weekends), though this may vary depending on verification steps.

Areas for Improvement

While the mobile version is generally responsive, the game filters can feel a bit awkward — users may need to scroll more than necessary to find preferred titles. The selection of game providers, while reliable, could benefit from the addition of more niche developers like Hacksaw Gaming or Nolimit City to increase variety.

The character-based design theme may not appeal to older users, as it feels slightly tailored to a younger demographic. However, this doesn’t detract from the core functionality of the site.

Final Verdict

Laimz lv isn’t trying to be a flashy, trend-setting casino — and that’s probably its strength. It delivers a local, reliable experience with a good range of games, a strong bingo offering, and honest promotions. For players in Latvia looking for a platform that’s intuitive, fair, and doesn’t overcomplicate things, Laimz is a practical and worthwhile choice.

It may not deliver fireworks, but it delivers consistency — and in online gambling, that can matter more.

-

Megaways Games: The Hybrid Between Slots and Table Games

Megaways Games: The Hybrid Between Slots and Table GamesThe evolution of online gambling mechanics continues to reshape the …

07/08/2025See more -

How Gaming Limits and Self-Control Mechanisms Influence...

How Gaming Limits and Self-Control Mechanisms Influence...Over the past decade, the conversation around responsible gambling has …

06/20/2025See more -

How Random Number Generator (RNG) Algorithms Work in Sl...

How Random Number Generator (RNG) Algorithms Work in Sl...Random Number Generators (RNGs) play a crucial role in the …

06/04/2025See more