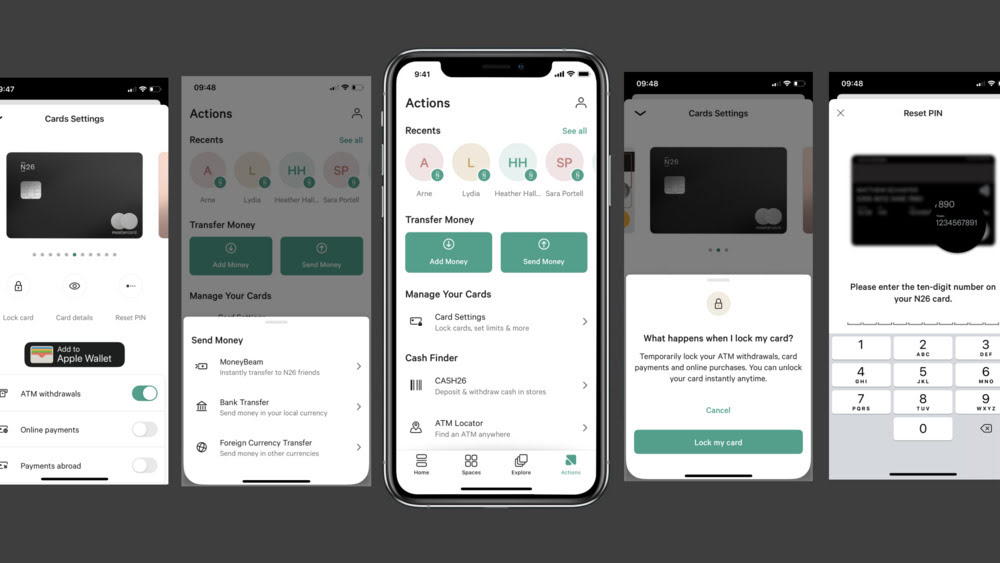

N26 payment system

In the dynamic landscape of digital banking, N26 has emerged as a significant player, revolutionizing the way we perceive and interact with financial services. This mobile-first bank, with its user-centric design and innovative features, has altered the banking paradigm, offering a seamless, efficient, and flexible banking experience.

The Story of N26: A Journey of Innovation and Growth

Founded in Berlin in 2013, N26 began as a fintech startup with a vision to simplify banking for the modern user. It quickly gained popularity due to its straightforward approach to banking, devoid of the complexities and rigidity often associated with traditional banks. With a rapidly growing user base, N26 has expanded its operations across various regions, continually enhancing its offerings to cater to a diverse clientele.

Advantages and Disadvantages: A Balanced View

Advantages:

- User-Friendly Interface: N26 offers an intuitive, easy-to-navigate app, making banking accessible even to the tech-averse.

- Low Fees: It’s known for its minimal fees, especially on international transactions, appealing to travelers and digital nomads.

- Real-Time Notifications: Instant alerts on transactions keep users informed and in control of their finances.

Disadvantages:

- Limited Physical Presence: Lacking physical branches, it might not appeal to those who prefer in-person banking services.

- Dependent on Internet Connectivity: Being an online-only platform, access to banking is contingent on internet availability.

How to Use N26 in Online Casinos

N26’s flexibility extends to the world of online casinos, like Jackpot Village Casino Online. Using N26 here is straightforward:

- Set Up an Account: Open an N26 account and fund it.

- Choose N26 at the Casino: Select N26 as your payment method on the casino’s payment page.

- Transfer Funds: Enter the amount and authorize the transaction to play.

Regions: Global Reach with a Local Touch

N26 has expanded its services across Europe and into the US, adapting to local financial regulations while maintaining its user-centric approach. This expansion reflects its commitment to providing a consistent banking experience across different regions.

Payment Methods: A Spectrum of Options

N26 supports a variety of payment methods, including direct bank transfers, mobile payments, and third-party services like TransferWise, ensuring users have multiple options to manage their finances effectively.

Customer Support: A Click Away

N26 offers robust customer support through its app and website, featuring live chat, email support, and a comprehensive FAQ section, ensuring that help is always a click away for its users.

Safety: Secure Banking at its Core

N26 prioritizes user safety with features like fingerprint and face recognition, two-factor authentication, and real-time transaction alerts. This commitment to security is a cornerstone of N26’s service, ensuring peace of mind for its customers.

Licenses: A Foundation of Trust

Operating under a European banking license, N26 adheres to stringent regulatory standards, ensuring that it meets high levels of financial security and consumer protection. This licensing is a testament to N26’s reliability and credibility as a financial institution.

-

Neteller: The Ultimate Payment Solution for Europeans

Neteller: The Ultimate Payment Solution for EuropeansWelcome to the comprehensive guide on Neteller, Europe’s esteemed payment …

04/08/2024See more -

Changes to the Roulette Game over the Ages

Changes to the Roulette Game over the AgesRoulette has undergone significant transformations, adapting to technological advancements and …

03/28/2024See more -

Satispay Review: Revolutionizing Mobile Payments

Satispay Review: Revolutionizing Mobile PaymentsWelcome to our in-depth review of Satispay, the innovative payment …

03/26/2024See more