Melio Payments: Revolutionizing Digital Transactions

Melio Payments, a significant player in the digital payment solutions sector, has redefined how businesses handle transactions. This comprehensive review traces the history of Melio’s creation, its rise to popularity, key achievements, unique anecdotes, potential future impacts, and a summarizing conclusion on its role in modern finance.

History of Melio’s Creation

Founded in 2018, Melio was established with the vision of simplifying business payments and accounts payable processes for small to medium-sized businesses. Recognizing the complexities and inefficiencies in traditional payment methods, Melio’s founders sought to create a user-friendly, digital-first solution that addressed the unique needs of modern businesses.

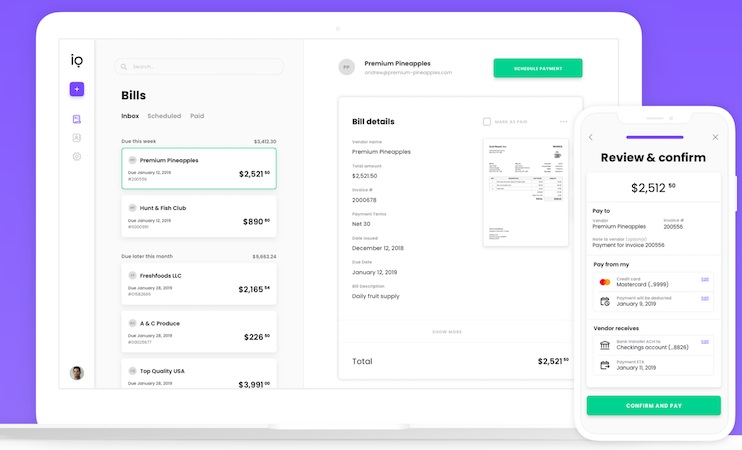

The platform started as a simple, intuitive tool designed to make digital payments more accessible, offering features like seamless integration with accounting software, easy invoice management, and flexible payment options. This foundation set the stage for Melio’s rapid growth and evolution in the digital payment space.

The Rise to Fame of Melio Payments

Melio gained popularity for its simplicity and efficiency in handling business payments. The key to its success was its ability to streamline the entire payment process, from invoicing to reconciliation, thereby saving time and reducing errors for businesses. Its user-centric design and focus on small to medium-sized businesses filled a significant gap in the market.

Word-of-mouth referrals, positive customer reviews, and partnerships with major accounting platforms further propelled Melio’s visibility and adoption. The platform’s ability to handle various payment formats, including ACH, credit cards, and paper checks, made it a versatile tool for diverse business needs.

Expansion and Recognition

Melio’s expansion into various industries and partnerships with leading financial institutions not only broadened its user base but also cemented its reputation as a reliable and innovative payment solution.

Main Achievements of Melio Payments

Melio’s achievements are numerous, including rapid user growth, significant transaction volumes, and recognition by financial industry leaders. The platform’s integration capabilities with popular accounting software like QuickBooks have been a game-changer, allowing businesses to synchronize their payment processes with their financial records seamlessly.

Further achievements include securing substantial funding from investors, indicating strong confidence in Melio’s business model and future growth prospects. The platform’s continual feature enhancements and scalability demonstrate its commitment to meeting the evolving needs of its users.

Industry Awards and Accolades

Melio’s innovative approach has earned it various industry awards and accolades, underlining its impact and leadership in the digital payments industry.

Funny Anecdotes Related to Melio Payments

Amidst its corporate achievements, Melio’s journey is not without its light-hearted moments. Stories from the startup phase, like impromptu brainstorming sessions and creative problem-solving under tight deadlines, reflect the team’s dedication and camaraderie.

Customer testimonials often highlight amusing scenarios where Melio’s simplicity and efficiency turned what used to be a tedious task into a surprisingly enjoyable experience, further humanizing the brand.

The Potential of Melio Payments

Looking ahead, Melio possesses immense potential to further transform and lead in the digital payments sector. With the increasing trend towards digitalization and e-commerce, Melio is well-positioned to capitalize on new market opportunities and technological advancements.

The potential for international expansion and diversification into other financial services offers exciting prospects for Melio’s growth and influence in global finance.

Conclusions on Melio Payments

In conclusion, Melio Payments stands out as a forward-thinking and innovative solution in the digital payments arena. Its user-friendly platform, coupled with a robust set of features, addresses the critical needs of modern businesses. Melio’s journey from a fledgling startup to a key player in digital transactions is a testament to its vision, adaptability, and the enduring value it provides to its users.

-

Apple Pay and Google Pay in Online Casinos: Where They ...

Apple Pay and Google Pay in Online Casinos: Where They ...Mobile payment services have become a common way to fund …

03/06/2026See more -

Betfair Casino — Game Comparison, RTP Logic and Bonus L...

Betfair Casino — Game Comparison, RTP Logic and Bonus L...Betfair Casino operates under the Flutter Entertainment group and remains …

02/17/2026See more -

Betinia Casino registration, KYC and financial limits i...

Betinia Casino registration, KYC and financial limits i...Registration and verification are not “extra steps” at Betinia — …

01/28/2026See more