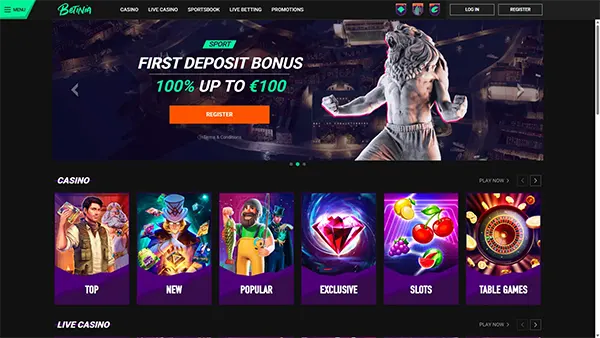

Betinia Casino registration, KYC and financial limits in 2026

Registration and verification are not “extra steps” at Betinia — they are the backbone of account security, compliance, and payout reliability. In 2026, regulated online casinos typically apply customer due diligence, safer-gambling controls, and transaction monitoring, so it’s worth understanding what you may be asked for before you request a withdrawal.

Registration and account basics: what you set up on day one

To create an account, you enter standard personal and contact details and confirm that you meet the legal age requirement (18+). This is also the moment to be precise: if your name, date of birth, or address later differs from what your documents show, verification can take longer because support will usually ask for clarification.

Most casinos operate a “one person, one account” policy in practice. Multiple accounts, duplicated profiles, or reusing the same payment instrument across different accounts can trigger checks, because these patterns are often linked to fraud prevention, responsible-gambling controls, or bonus misuse investigations.

Think about registration as the first step of account hygiene. Choose the currency you genuinely plan to use, keep your email and phone number active, and avoid rushing through fields. If a withdrawal is reviewed later, reachable contact details can help resolve questions quickly.

Practical registration checks that can trigger early verification

Verification can be requested immediately after sign-up or later, depending on how you use the account. Even if you can deposit and play right away, many operators still verify customers when withdrawals begin or when transaction patterns change.

Common triggers include the first withdrawal, changing key personal details, unusually large deposits, repeated failed payment attempts, or switching to a different payment method. These checks are usually framed as risk controls: they aim to prevent unauthorised access, chargebacks, and identity misuse.

If you want fewer interruptions, do a quick self-check right after you register: confirm your legal name and address format match your documents, and keep clear photos or PDFs ready. Clean, consistent details reduce back-and-forth later.

KYC and document verification: what is usually requested and why

KYC (Know Your Customer) is the process of confirming identity and assessing whether account activity fits a legitimate customer profile. In 2026, operators generally apply a risk-based approach, which means the depth of checks can increase if there are indicators of higher risk.

Typically, you should be prepared to provide a government-issued photo ID and proof of address. Depending on the payment method and the account activity, you may also be asked to confirm ownership of the payment method (for example, through specific screenshots or account statements).

The key principle is consistency. If your account details match your documents, verification tends to be straightforward. If something has genuinely changed — a new address or a name change — update your account before you request a larger payout, because changes can lead to re-checks.

Source-of-funds questions and enhanced checks in 2026

For higher-value play, unusual transaction patterns, or certain risk profiles, an operator may request evidence that explains where deposited funds come from. This is commonly described as “source of funds” or, more broadly, “source of wealth” checks.

What you provide depends on your circumstances. Examples can include payslips, tax documents, bank statements showing salary deposits, or other paperwork that reasonably supports the funds used for gambling. Requests are usually proportional to the level of activity being reviewed.

To avoid delays, send clear, unedited files, ensure your name is visible, and only redact information that is not needed. Blurry images, cropped documents, or mismatched dates often lead to follow-up questions and longer manual reviews.

Financial limits and safer-gambling controls: deposits, withdrawals and caps

Deposit limits usually depend on the payment method and can be shown directly in the cashier. Minimum deposits are often fixed, while maximum amounts vary by card type, e-wallet, or bank transfer rules. As a result, two players can see different caps depending on which method they select.

Withdrawals typically have two time components: internal review by the finance team and the external processing time of the payment network. E-wallets can be faster after approval, while card withdrawals can take longer because of how card settlements work.

Limits aren’t only a payments rule — they’re also a practical safety tool. Setting deposit caps, loss limits, or cooling-off periods early can help you keep gambling within a budget and avoid chasing losses when emotions run high.

How VIP tiers can affect withdrawal ceilings

Some casinos apply tier-based withdrawal limits where higher VIP levels come with higher monthly payout ceilings. This can matter if you play regularly and prefer predictable cash-out capacity rather than multiple small withdrawals.

Even if VIP limits are higher, verification requirements do not disappear. In fact, larger or more frequent transactions are more likely to be reviewed, because higher-value activity generally increases the need for consistency checks and fraud prevention.

A sensible approach is to combine “technical” limits with habits: set deposit caps, use time reminders if available, and take breaks if gambling stops feeling like entertainment. If you notice loss-chasing or stress, cooling-off or self-exclusion tools are there for a reason and can be a strong reset.

-

Betinia Casino registration, KYC and financial limits i...

Betinia Casino registration, KYC and financial limits i...Registration and verification are not “extra steps” at Betinia — …

01/28/2026See more -

Why Red/Black in Roulette Isn’t 50/50: A Mathematical B...

Why Red/Black in Roulette Isn’t 50/50: A Mathematical B...At first glance, betting on red or black in roulette …

01/07/2026See more -

The Impact of Mobile Devices on Gambling Game Design an...

The Impact of Mobile Devices on Gambling Game Design an...The widespread adoption of smartphones and tablets has fundamentally reshaped …

12/18/2025See more